Well, I’ve finally got some skin in the game.

I began attending Memphis Investors Group (MIG) meetings in January of 2012. (MIG is a group of property investors put together to help educate people on better ways to own, manage and make money at investment properties, commercial buildings, and rental units). I originally began going because my father is aging and I wanted to help him manage his property portfolio, (big word for one office building and a rent house), but I wanted to make sure that leases and policies were up to date and legal, etc. He had not done any type of updates to his leases in many years and was losing interest in the day-to-day operations of the office building and always had a hard time getting his house tenant to pay rent on time. I needed to help him, paybacks for all those favors he did for me while I was growing up. Now I keep his books as far as his properties are concerned, which really isn’t hard, I receive the rent checks, send invoices, go to the bank each month, nothing that is too time consuming, but I feel better knowing that he is getting his money. I don’t ask for money, I’m not a real estate agent and by law I can’t be a “Property Manager” so, I just take care of my dad by helping him.

All that said, I became very interested in owning my own properties because of attending the MIG meetings. The meetings are quite interesting and there seem to be easy ways to get into the game. I have learned so much that I now want to get myself into the game.

A question that is commonly asked at MIG is “How many offers did you make last week (month, year, etc)?” If not, why now? For me this question has been a no-brainer as of late. I was not fully educated and needed to do a lot more study and prep work before I jumped in with both feet and all my money. Don’t get me wrong, I’ve WANTED to just jump in a play with the big boys, but I knew that wasn’t possible. I’ve never had a lot of money (I was a single parent of 3 for a number of years) and what money I have managed to accumulate, which still isn’t much, was TOO hard to get, so letting it go to some get-rich-quick scheme was not on my list of “to-dos”. But I went religiously to the meetings and have listened at every opportunity. I have gone to training seminars, I have read books, I have listened to national speakers, I have even gone to weekly lunch meetings, which are 100% informal meetings, but given a few questions, those who are experienced teach you one on one.

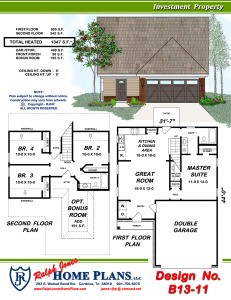

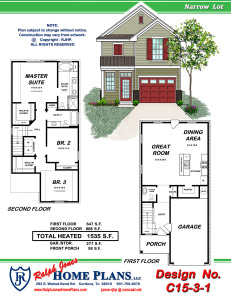

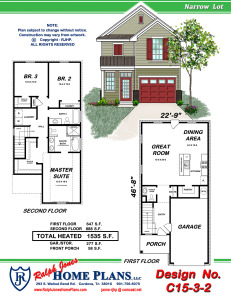

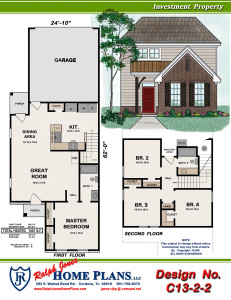

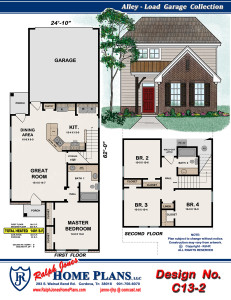

I have been looking for the perfect situation. The perfect place to buy to begin my property investment career. It has not materialized … yet. I was looking for a duplex in a particular area of town. My main reason for a duplex in that area of town was because of one of my kids who wants to live in that area and keeps finding herself with no place to live. I thought I could buy a duplex and rent one side to my daughter and the other to some random stranger. The daughter could do all the rent collecting for that unit, she could add her rent and pay the notes, I could teach her some homeowner responsibilities and still be “in the game” myself. Well, one can only look for so long before one goes crazy and quite frankly, when has buying a place for your own kid ever worked out? EVERYONE I talk to says it’s a horrible idea. You get stuck with all the bills, HOA fees, lawn mowing, etc., because the kid doesn’t have any skin in the game. SO, suddenly it hit me: I design homes for a living. I’ve been concentrating recently on investment type homes (inexpensive to build with very few kitchen cabinets or bathroom cabinets, no frills, just walls, rooms and toilets. The investor I have been designing for wants 4 bedrooms, 2 bathrooms and 2-car garages all in 13-1400 sq. ft. heated. No porches to speak of, just a small covered stoop so that they can claim to have a porch, but in all practicality, there really isn’t much porch). This said, why not look for building lots which have been foreclosed, or are distressed for whatever reason.

So, I changed my way of looking for properties, I began to look for LOTS rather than used houses. I found some lots. I actually found some quite affordable subdivision lots, in a great area of town, ready to be built on, and not in a flood zone. There are some other strings attached at the moment, but I won’t get into that in this epistle of a blog post, but I will say this, others have run away from these lots because the LOOK scary. They are cove lots, tiny cove lots. They have easements running through them that would make a grown builder cry…. but mainly because they’d need to have a custom home designed for the lot. My advantage, I can do that for myself! I can design a house that will fit on each lot if I have to. So, after talking to many advisers (my father, not one, but two attorneys, several builders, a title company or two), I have decided to put some skin in the game.

I laid some money on the table and made an offer. I NOW have skin in the game. I don’t know if it will go through or not, but I am both hopeful it will and terrified that it will all at the same time. Needless to say, I’m not ALL THE WAY in the game, but I did leave a few fingernail indentions in the chair and a few bucks on the table. NOW I can say I have some skin in the game, but only time will tell if I win the bid, or if I’m let off the hook. I think I will be sad if it doesn’t go through, but if it does, I will be terrified for the next step…. building a house. Wow! We shall see……….